Summary

The purpose of this document is to provide guidance for the standard procedures when requesting Expendable, Endowed – Temporarily Restricted (a.k.a. Quasi) funds, and/or Endowed – Permanently Restricted and will describe when to use a ‘Disbursement Request’ vs. when to submit a ‘Fund Closure’ form.

Key Takeaways

- The type of fund you are requesting monies from (callable, endowed etc.) affects which type of request you would use to fully draw down its available balance.

- If your intent is to close a callable fund, please submit a Fund Closure Request form. If your intent is to request a portion of the balance of a callable fund, fill out a check request.

Definitions:

Expendable Funds

An expendable fund typically supports university priorities for a finite period of time and in a flexible manner. Generally, gifts in the callable pool — which is made of expendable funds — are spent in their entirety within three years or fewer.

Permanent Endowment Funds

Gifts designated by a donor to be invested into perpetuity. Endowment funds are placed within a unitized pool to be invested with a long-term strategy intended to grow the endowment balance and produce a stream of income to support ongoing university programs.

Temporary (a.k.a. Quasi) Endowment Funds

A temporary endowment, or a fund functioning as an endowment, is a fund that is invested to provide income for a long but unspecified period, and the governing authority can expend the principal of the fund at any time.

Expendable Cash (EC)

Cash available for immediate spending according to the donor’s wishes as outlined in the fund description. Expendable cash can be a combination of gifts given by donors to be available for immediate spending (spendable cash) or distributions from endowed funds which are generated on a quarterly basis (spendable endowment income). Expendable cash is not invested in the endowment investment portfolio and does not earn interest.

Expendable Funds

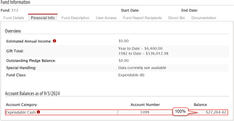

Requesting the disbursement of a portion of the balance of a expendable fund: A disbursement request, approved by the Dean/Divisional Business Fiscal Office or approving authority may be submitted requesting any portion of the balance in 1099 – Expendable Cash. See screenshot below.

Requesting the disbursement of the full balance of a expendable fund: If the intent is to close the fund, please submit a Fund Closure Request form. The Finance team will use the Fund Closure form to initiate the disbursement consisting of 100% of the balance in 1099 – Expendable Cash and close the fund.

Temporarily Restricted Endowment (a.k.a. Quasi) Funds

Temporarily Restricted Endowed (a.k.a. Quasi) funds are intended to operate in a similar manner as Permanent Endowed funds. While there is flexibility to spend from the principal, these funds are established with the intention of investing gifts over a long-term horizon. Best practice is to spend from the income available and wait at least 5 years after the initial investment before dipping into the principal.

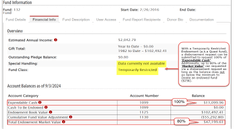

Requesting the disbursement of a portion of the balance of a Temporarily Restricted endowment fund: A disbursement request can be submitted requesting 100% of the balance in 1099 – Expendable Cash. Additionally, up to 80% of the endowment market value can be requested with a disbursement request, without any other action needed, as long as the endowment market value does not go below the minimum amount to create an endowment, which is $25,000. See screenshot below.

Note: Please provide a screenshot of the fund balances when you submit your check request for approval so that the full balance of the fund is visible, not only the balance in 1099 Expendable Cash, for the individual approving the request. This will provide the information needed to determine if the request fits within these guidelines outlined in this document.

Requesting the disbursement of the full balance of a Temporarily Restricted endowment fund: If the intent is to close the fund, please submit the Fund Closure Request form. It is important to keep in mind that while this type of fund is not permanently restricted, it is part of the endowment pool. Therefore, the full amount of the fund will not be disbursed until the fund is liquidated. Liquidation of the fund will occur during the quarter-close procedures following a review by the WFAA Finance team.

The Finance team will use the Fund Closure form to initiate the first disbursement consisting of 100% of the balance in 1099 – Expendable Cash, and 80% of the endowment market value. After the fund is liquidated and the quarter is closed, the balance will automatically be disbursed to the same 233 as the first payment unless otherwise instructed.

The minimum Endowment Market Value (EMV) balance must be $125,000 or greater to request the full 80% on the disbursement request. EMV balances below $125,000 will reduce the amount you can request from 80% of the Endowment Market Value to: EMV balance – Endowment minimum ($25K)

Example 1 – small endowment fund:

Endowment Market Value (EMV) is $50,000.

.8 x $50,000 = $40,000 leaves $10,000 balance

$10,000 < endowment minimum ($25k) therefore,

*80% of EMV cannot be requested since the endowment level would go below the $25,000 minimum level.

EMV balance – Endowment minimum = Max request amount ($50k – $25k = $25k)

Up to $25,000 may be requested.

Example 2 – large endowment fund:

Endowment Market Value (EMV) is $1,000,000.

.8 x $1,000,000 = $800,000 leaves $200,000 balance

$200,000 > endowment minimum ($25k) therefore,

*80% of EMV can be requested since the endowment level would stay above the $25,000 minimum level.

Up to $800,000 may be requested.

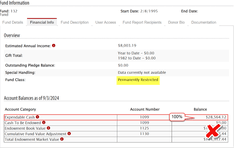

Permanently Restricted Endowment Funds

Requesting the disbursement of a portion of the balance of a Permanently Restricted endowment fund: Permanently restricted endowment funds are intended to live in perpetuity. A disbursement request can be submitted requesting 100% of the balance in 1099 – Expendable Cash. Endowment appreciation may only be used with permission from the donor as determined in the fund agreement.